A slew of recent blockbuster video game hits by NetEase Inc. is giving bulls renewed optimism that the firm’s 85% rally since an October low has more room to run.

Since launching in China on Friday, the company’s Justice Mobile — an AI powered martial arts game — has ranked among the top three highest-grossing video games in the country. Along with Eggy Party and the Racing Master, they made up China’s three most downloaded video games on July 2, according to Goldman Sachs Group Inc.

The blockbuster hits are changing fortunes for NetEase, which about a year ago was still reeling from a freeze in new gaming approvals following Beijing’s crackdown on the sector. They are also offering a much-needed boost to investors looking for proof that the recent gains will hold even as the broader Chinese equities market remains lackluster given broader economic weakness.

“The online gaming sector is one of the best sectors across the whole Internet space. Investors should consider to hold on to in time of macro uncertainty,” said Jialong Shi, an analyst at Nomura International HK Ltd. “We think NetEase will do better than most of these online gaming peers on the back of a stronger game pipeline.”

NetEase has edged out rivals Tencent Holdings Ltd. and Bilibili Inc. to become one of the best performers on the Hang Seng Tech Index since the end of October, when news of China’s reopening sent markets soaring. While e-commerce and online advertising are directly impacted by weak consumption, mobile game revenue is considered less vulnerable to economic volatility as its users tend to be sticky.

NetEase Primed For Turnaround After Games Approval: Tech Watch

On Tuesday, NetEase’s Hong Kong shares closed at the highest in over a year. Analysts expect that shares could rise another 17%, according to Bloomberg-compiled data of average 12-month target price estimates. That compares with a 0.5% decrease for Nintendo Co. shares and 9.5% for Activision Blizzard Inc. versus last close.

For Goldman Sachs analyst Lincoln Kong, who raised his target on the stock by about 5% on Monday, NetEase still offers “attractive upsides” even after the sector-beating rally.

The Wall Street bank also nudged up its game revenue assumption by 1.3%-1.4%, “reflecting NetEase’s proven track record in expanding into previously untapped genre with new titles by innovative gameplay,” Kong wrote. He added that revenue contribution from the four new titles including Harry Potter: Magic Awakened, which launched in Japan last week, is boosting the bottom line.

There are some signs that the rally may be due for a correction, at least in the short term. Its shares are close to the overbought zone based on the 14-day relative strength index. Some analysts are also wary about whether NetEase will be able to carry the momentum for new launches through the rest of the year.

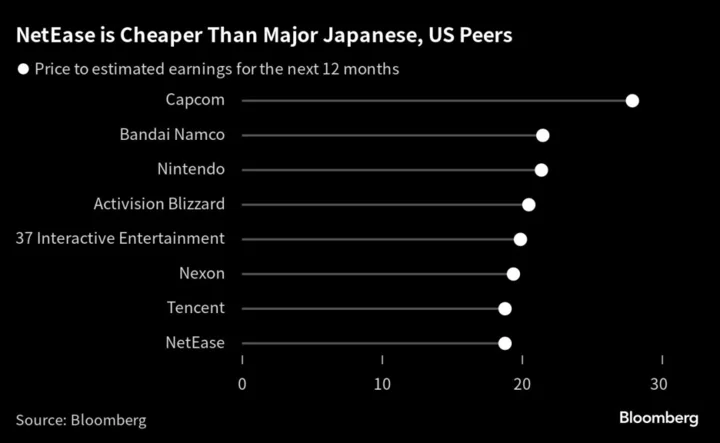

Trading at 18.7 times forward earnings, NetEase is still cheaper than its global peers such as Nintendo and Activision, which are trading at about 20 times. It’s now in line with Tencent while Bilibili remains loss making.

But there are broader upsides, including a removal of regulatory overhang that plagued many tech companies through 2021 and 2022. A strong gaming pipeline, including the launch for highly anticipated Where Wind Meets in 2024 will also help sentiment.

“Earnings revisions should come through as new titles achieve successes overseas,” Morningstar Inc. analysts including Daniel Rohr wrote in a note. “We expect strong performance to continue” and “investors should take advantage of market weakness to buy this narrow-moat business.”

Top Tech Stories

- Twitter Inc. said its temporary cap on the number of tweets that accounts can see each day has had minimal impact on advertising in the social-media platform.

- Meta Platforms Inc.’s Threads app — the social network launching this week to take on Twitter Inc. — isn’t yet appearing in some European app stores after users in the US and UK were offered a preorder option.

- Rakuten Group Inc. shares fell after news that the Japanese e-commerce company has taken a step to list its online brokerage arm.